Your State and local income tax refund worksheet 2019 images are available in this site. State and local income tax refund worksheet 2019 are a topic that is being searched for and liked by netizens now. You can Get the State and local income tax refund worksheet 2019 files here. Find and Download all free photos.

If you’re looking for state and local income tax refund worksheet 2019 pictures information related to the state and local income tax refund worksheet 2019 keyword, you have visit the right blog. Our site always gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that fit your interests.

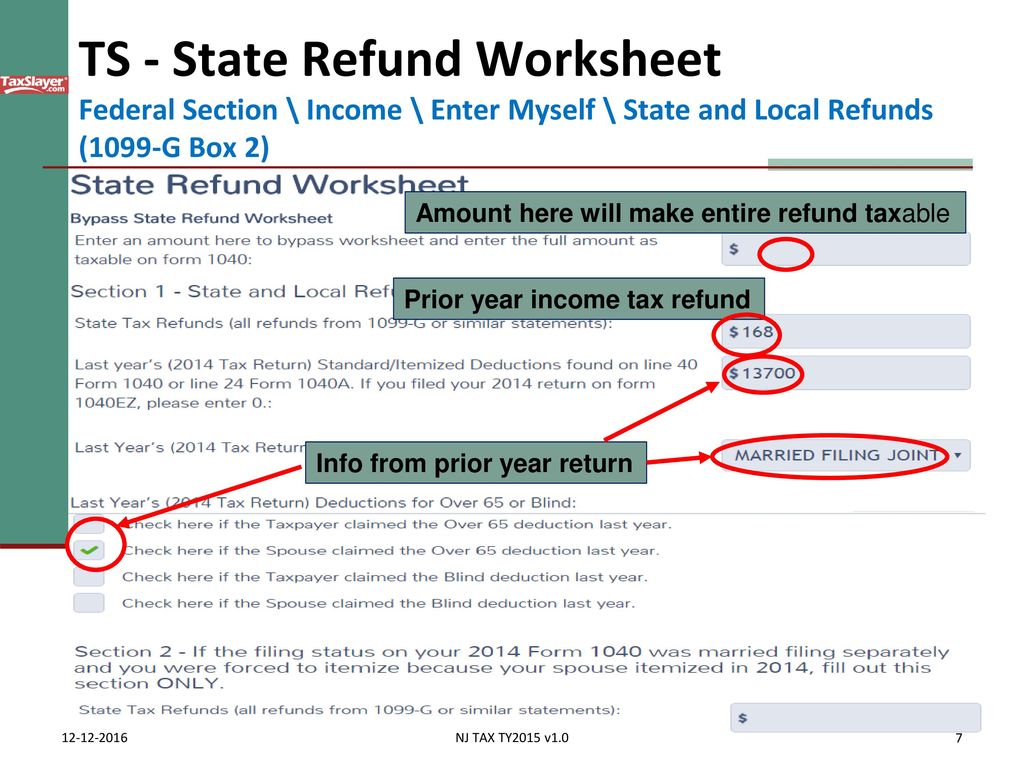

State And Local Income Tax Refund Worksheet 2019. The entire refund is calculated as taxable. Look for a worksheet named Wks CY Refunds 20XX State and Local Income Tax Refund Worksheet and review it for information on whether or not there will be a taxable event. 1017 Taxable state income tax refund Sch 1 line 1 TSO. The amount of your state and local income taxes shown on your 2017 Schedule A line 5.

W3 Form Explanation 3 Unbelievable Facts About W3 Form Explanation Reference Letter For Student Unbelievable Facts Printable Job Applications From in.pinterest.com

W3 Form Explanation 3 Unbelievable Facts About W3 Form Explanation Reference Letter For Student Unbelievable Facts Printable Job Applications From in.pinterest.com

Because of the limit however the taxpayers SALT deduction is only 10000. A total of 12000 in state and local taxes is listed on the return including state and local income taxes of 7000. Go to the 99G screen and enter information in the Additional Box 2 Information fields. Allie had 5000 in state income taxes withheld in 2018 and her state tax liability was only 3200. From what Ive seen so far the 1099-Gs showing the state income tax refunds DO include the 110220 refund and will NOT match what carries forward in ProSeries or any other software so not a slam on PS Rick in VA. When I recalculate previous years itemized deduction by reducing the state tax payment by the refund amount - increase in tax liability is not same as amount taxable on state tax recover worksheet by proseries in current year.

In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750 refund.

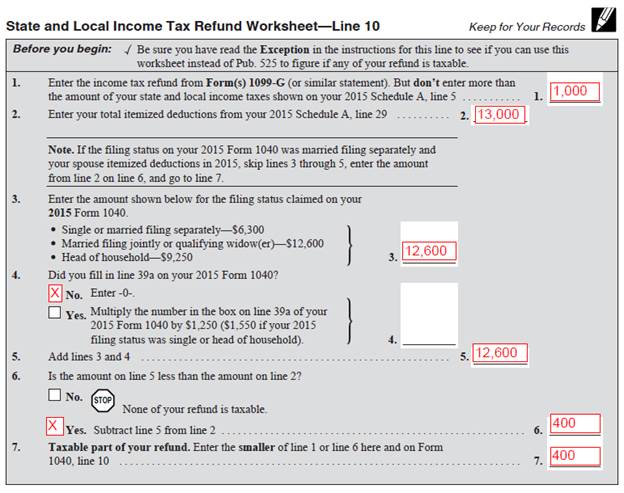

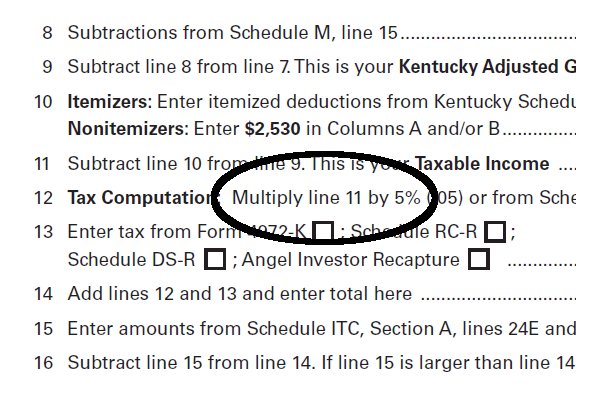

State and Local Income Tax Refund WorksheetSchedule 1 Line 10 Be sure you have read the Exception in the instructions for this line to see if you can use this worksheet instead of Pub. If you did not itemize your deductions or elected to deduct the state and local sales tax rather than the state and local income tax on your 2019 return you do not need to complete the worksheet. Because of the limit however the taxpayers SALT deduction is only 10000. TURBO TAX ERROR on 2019 1040 State and Local Income Tax Refund Worksheet Part III Recovery Exclusion. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750 refund. I should be able to enter an amount into the program to calculate the.

Source: twitter.com

Source: twitter.com

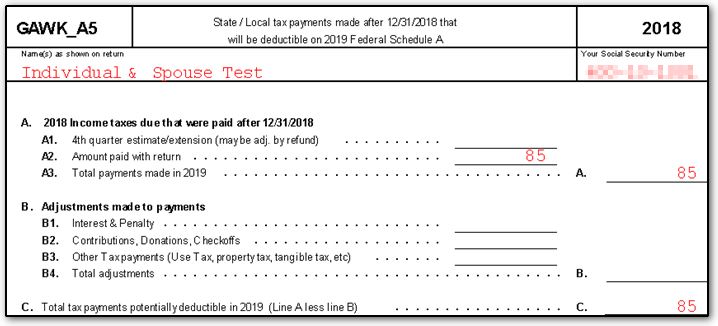

Calculate and view the return. Local Tax Income Tax Rate Change. Dorchester Countys tax rate increased from 262 to 320. Not sure how the number in part III line 7 b 1 A Re-figured state and local. State and local estimated tax payments made during 2020 including any part of a prior year refund that you chose to have credited to your 2019 state or local income taxes.

Source: twitter.com

Source: twitter.com

To review the calculations andor print the State Income Tax Refund worksheet. 525 to figure if any of your refund is taxable. Dorchester Countys tax rate increased from 262 to 320. Not sure how the number in part III line 7 b 1 A Re-figured state and local. The State Refund Worksheet reflects the calculation of the amount if any of the state income tax refund received that would be taxable and transferred to Line 1 of IRS Schedule 1 Form 1040.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

If the taxpayer itemized in the prior year. Include state tax withheld and state estimated payments made during 2019. In Drake15 and prior this worksheet is titled WK_REFXX XX being the last 2 digits of the year. Because of the limit however the taxpayers SALT deduction is only 10000. When calculating the TAXABLE amount of the state income tax refund on the State and Local Income Tax Refund Worksheet - Part III Recovery Exclusion.

Source: incometax.utah.gov

Source: incometax.utah.gov

Include state tax withheld and state estimated payments made during 2019. All state and citylocal taxes based on income entered on Business worksheet Taxes and Licenses section or accrued from state and citylocal returns and state income franchise taxes entered on Federal Income and Deduction category Rental and Royalty worksheet Expenses section carry as an addition to federal taxable income. 525 to figure if any of your refund is taxable. However when certain exceptions exist the taxpayer may be required to treat the state or local tax refund as an Itemized Deduction Recovery in Publication 525 instead of using the worksheet. The taxable portion will be included on the return as taxable income.

Source: pinterest.com

Source: pinterest.com

From what Ive seen so far the 1099-Gs showing the state income tax refunds DO include the 110220 refund and will NOT match what carries forward in ProSeries or any other software so not a slam on PS Rick in VA. Line 7b 1 b is Blank. When I recalculate previous years itemized deduction by reducing the state tax payment by the refund amount - increase in tax liability is not same as amount taxable on state tax recover worksheet by proseries in current year. Enter the income tax refund from Forms 1099-G or similar statement. 525 to figure if any of your refund is taxable.

Source: pinterest.com

Source: pinterest.com

In December 2018 a small fire caused by her old homes faulty wiring resulted in 8000 damage to her home. When calculating the TAXABLE amount of the state income tax refund on the State and Local Income Tax Refund Worksheet - Part III Recovery Exclusion. State and local estimated tax payments made during 2020 including any part of a prior year refund that you chose to have credited to your 2019 state or local income taxes. For the 2019 IRS Form 1040 tax return it is likely that the instructions for the line Taxable refunds credits or offsets of state and local income taxes will contain a simple worksheet for implementing this general rule. Use a copy of the taxpayers previous year return to enter all amounts in the spaces provided.

Source: oatc-oregon.org

Source: oatc-oregon.org

Worksheet instead of Pub. Baltimore Countys tax rate increased from 283 in 2019 to 320 in 2020. The amount of the state or local refund that needs to be included in your income is the smaller of these two amounts. Not sure how the number in part III line 7 b 1 A Re-figured state and local. To review the calculations andor print the State Income Tax Refund worksheet.

The amount of the state or local refund that needs to be included in your income is the smaller of these two amounts. A total of 12000 in state and local taxes is listed on the return including state and local income taxes of 7000. Not sure how the number in part III line 7 b 1 A Re-figured state and local. 525 to figure if any of your refund is taxable. State and local estimated tax payments made during 2020 including any part of a prior year refund that you chose to have credited to your 2019 state or local income taxes.

Source: vitastateguide.com

Source: vitastateguide.com

TURBO TAX ERROR on 2019 1040 State and Local Income Tax Refund Worksheet Part III Recovery Exclusion. The State Refund Worksheet reflects the calculation of the amount if any of the state income tax refund received that would be taxable and transferred to Line 1 of IRS Schedule 1 Form 1040. If you itemized deductions on your federal return in the year you received the refund all or a portion of that refund may be taxable. If the taxpayer itemized in the prior year. The amount of the state or local refund that needs to be included in your income is the smaller of these two amounts.

Source: theofy.world

Source: theofy.world

Not sure how the number in part III line 7 b 1 A Re-figured state and local. The taxable portion will be included on the return as taxable income. Also review the State and Local Income Tax Refund Worksheet found in the Instructions to Schedule A to determine the taxable portion of the refund. All state and citylocal taxes based on income entered on Business worksheet Taxes and Licenses section or accrued from state and citylocal returns and state income franchise taxes entered on Federal Income and Deduction category Rental and Royalty worksheet Expenses section carry as an addition to federal taxable income. In Drake15 and prior this worksheet is titled WK_REFXX XX being the last 2 digits of the year.

Source: wm.edu

Source: wm.edu

When I recalculate previous years itemized deduction by reducing the state tax payment by the refund amount - increase in tax liability is not same as amount taxable on state tax recover worksheet by proseries in current year. Washington Countys tax rate increased from 28 in 2019 to 32 in 2020. But do not enter more than. When calculating the TAXABLE amount of the state income tax refund on the State and Local Income Tax Refund Worksheet - Part III Recovery Exclusion. Allie had 5000 in state income taxes withheld in 2018 and her state tax liability was only 3200.

Source: theofy.world

Source: theofy.world

If your total itemized deductions are greater than your standard deduction AND you dont deduct Sales Taxes. Dorchester Countys tax rate increased from 262 to 320. When calculating the TAXABLE amount of the state income tax refund on the State and Local Income Tax Refund Worksheet - Part III Recovery Exclusion. Line 7b 1 b is Blank. A total of 12000 in state and local taxes is listed on the return including state and local income taxes of 7000.

Source: twitter.com

Source: twitter.com

Not sure how the number in part III line 7 b 1 A Re-figured state and local. I should be able to enter an amount into the program to calculate the. The entire refund is calculated as taxable. To review the calculations andor print the State Income Tax Refund worksheet. When I recalculate previous years itemized deduction by reducing the state tax payment by the refund amount - increase in tax liability is not same as amount taxable on state tax recover worksheet by proseries in current year.

Source: vitastateguide.com

Source: vitastateguide.com

VA refunded up to 110 per taxpayer so 220 for MFJ in October 2019 which will NOT carry forward from the prior year software. All state and citylocal taxes based on income entered on Business worksheet Taxes and Licenses section or accrued from state and citylocal returns and state income franchise taxes entered on Federal Income and Deduction category Rental and Royalty worksheet Expenses section carry as an addition to federal taxable income. TURBO TAX ERROR on 2019 1040 State and Local Income Tax Refund Worksheet Part III Recovery Exclusion. When calculating the TAXABLE amount of the state income tax refund on the State and Local Income Tax Refund Worksheet - Part III Recovery Exclusion. Line 7b 1 b is Blank.

Enter the income tax refund from Forms 1099-G or similar statement. To review the calculations andor print the State Income Tax Refund worksheet. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750 refund. Local Tax Income Tax Rate Change. If her itemized deductions totaled 17000 in 2018 the maximum taxable amount of any state tax refund received in 2019 is 5000 17000 12000.

Source: tax.thomsonreuters.com

Source: tax.thomsonreuters.com

The amount of the state or local refund that needs to be included in your income is the smaller of these two amounts. A total of 12000 in state and local taxes is listed on the return including state and local income taxes of 7000. Baltimore Countys tax rate increased from 283 in 2019 to 320 in 2020. State and Local Income Tax Refund WorksheetSchedule 1 Line 10 Be sure you have read the Exception in the instructions for this line to see if you can use this worksheet instead of Pub. But do not enter more than.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

TS Income State and Local Refunds Bypass worksheet line Taxable PTR refund Taxable HB refund Other income Sch 1 line 8 TSO. If the taxpayer itemized in the prior year. Worksheet instead of Pub. Look for a worksheet named Wks CY Refunds 20XX State and Local Income Tax Refund Worksheet and review it for information on whether or not there will be a taxable event. The amount of the state or local refund that needs to be included in your income is the smaller of these two amounts.

Source: investopedia.com

Source: investopedia.com

From what Ive seen so far the 1099-Gs showing the state income tax refunds DO include the 110220 refund and will NOT match what carries forward in ProSeries or any other software so not a slam on PS Rick in VA. VA refunded up to 110 per taxpayer so 220 for MFJ in October 2019 which will NOT carry forward from the prior year software. The State Refund Worksheet reflects the calculation of the amount if any of the state income tax refund received that would be taxable and transferred to Line 1 of IRS Schedule 1 Form 1040. Include state tax withheld and state estimated payments made during 2019. Worksheet instead of Pub.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title state and local income tax refund worksheet 2019 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.