Your Adjusted qualified education expenses worksheet images are available. Adjusted qualified education expenses worksheet are a topic that is being searched for and liked by netizens today. You can Find and Download the Adjusted qualified education expenses worksheet files here. Download all royalty-free photos.

If you’re looking for adjusted qualified education expenses worksheet pictures information linked to the adjusted qualified education expenses worksheet interest, you have come to the ideal blog. Our site always provides you with suggestions for seeking the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

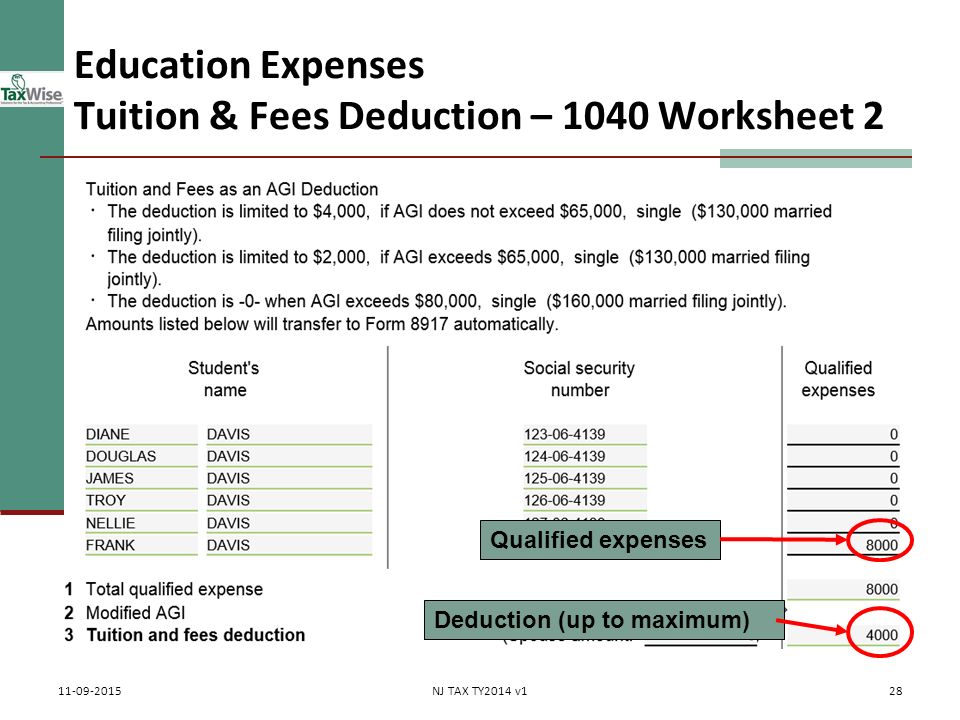

Adjusted Qualified Education Expenses Worksheet. This total would become the qualified expenses plus any eligible books and supplies. Student graduated college May 2019 was a full time student for one semester in 2019. Fill out the credit section for the one you want to claim. Ad The most comprehensive library of free printable worksheets digital games for kids.

Which Tax Form To File Now That 1040a 1040ez Are No Longer Used Irs Com Tax Forms Estimated Tax Payments Federal Income Tax From pinterest.com

Which Tax Form To File Now That 1040a 1040ez Are No Longer Used Irs Com Tax Forms Estimated Tax Payments Federal Income Tax From pinterest.com

Qualified education expenses must be paid by. Enter the students adjusted qualified education expenses for line 27. You can claim an education credit for qualified education expenses paid by cash check credit or debit card or paid with money from a loan. Form 1098-T for 2019 does not include any amounts. Ad The most comprehensive library of free printable worksheets digital games for kids. Education Credits Worksheet Page 2 of 2 Each of the education credits covers some education expenses none of them cover all expenses.

Enter the total of all amounts from all Parts III line 30 on Part I line 1.

Based on your education expenses scholarships and grants reported on your Form 1098-T and information found on your account activity statement from your school we have filed your education credit in the following manner. If the amount in Box 5 is greater than the amount in Box 1 then you are not eligible to take an education credit. You can claim an education credit for qualified education expenses paid by cash check credit or debit card or paid with money from a loan. Enter the total amount of any scholarship or. Distributions are adjusted qualified education expenses required for college productivity tools and equipment is the benefit. Student graduated college May 2019 was a full time student for one semester in 2019.

Source: pinterest.com

Source: pinterest.com

Education Expenses Worksheet for 2017 Tax Year To be used in determining potential education credits on 2017 tax return American Opportunity Credit Lifetime Learning Credit Attach a copy of the students account summary for each semester accessible via schools online portal to this worksheet. 1 tuition 19560 2 books and supplies 1001 3 room and board 9504 and 4 computersoftware 2397. Ad The most comprehensive library of free printable worksheets digital games for kids. Education Credits Worksheet Page 2 of 2 Each of the education credits covers some education expenses none of them cover all expenses. See Qualified Education Expenses earlier.

Source: pinterest.com

Source: pinterest.com

If the resulting qualified expenses are less than 4000 the student may choose to treat some of the grant as income to make more of the expenses eligible for the credit. Mapping Diagram Worksheet Time Management Worksheets For Adults Scientific Notation Addition And Subtraction Independent Practice Worksheet Factor The Common Factor Out Of Each Expression Worksheet Cell Transport Review Worksheet Answer Key Electric Charge And Static Electricity Worksheet 21 Day Fix Worksheets Protein Structure Pogil Worksheet Answers Chapter 15. How to fill out adjusted qualified education expenses worksheet. Adjusted Qualified Education Expenses Worksheet. Enter the total of all amounts from Part III line 31 on Part II line 10.

My son is a full-time college student. 16 Deducted on Sched A 17 Used for credit or deduction 18 Used for exclusion See tax help 19 Total adjustments. Student graduated college May 2019 was a full time student for one semester in 2019. Taxable Scholarship and Fellowship Income 1. How to fill out adjusted qualified education expenses worksheet.

Taxable Scholarship and Fellowship Income 1. Enter the students adjusted qualified education expenses for line 27. Qualified education expenses dont include the cost of. Lifetime Learning Credit Line 31 Enter the students adjusted qualified education expenses on line 31. Ad The most comprehensive library of free printable worksheets digital games for kids.

Source: in.pinterest.com

Source: in.pinterest.com

_____ in qualified education expenses were included in your tax return on Form 8863 to calculate your education credit. From line 1 you get qualified education expenses of 4500. For example Box 5 is 1000 and Box 1 is 3000 then the qualified expense amount would be 2000 plus any books or supplies. Use the Adjusted Qualified Education Expenses Worksheet to calculate the amount for line 27 reducing education expenses by any tax-free scholarships and grants. Student graduated college May 2019 was a full time student for one semester in 2019.

Source: in.pinterest.com

Source: in.pinterest.com

Get thousands of teacher-crafted activities that sync up with the school year. See Qualified Education Expenses earlier. Room and board Travel Research Clerical help Equipment and other expenses not required for enrollment in or attendance at an eligible educational institution Worksheet 1-1. 16 Deducted on Sched A 17 Used for credit or deduction 18 Used for exclusion See tax help 19 Total adjustments. Based on his adjusted qualified education expenses of 4000 Bill would be able to claim an American opportunity tax credit of 2500.

Source: pinterest.com

Source: pinterest.com

Ad The most comprehensive library of free printable worksheets digital games for kids. Ad The most comprehensive library of free printable worksheets digital games for kids. Based on his adjusted qualified education expenses of 4000 Bill would be able to claim an American opportunity tax credit of 2500. Enter the total of all amounts from Part III line 31 on Part II line 10. 2 Elect the American Opportunity Credit 3 Elect the Lifetime Learning Credit 4 Elect the tuition and fees deduction 4 Not applicable.

Source: pinterest.com

Source: pinterest.com

For example Box 5 is 1000 and Box 1 is 3000 then the qualified expense amount would be 2000 plus any books or supplies. My son is a full-time college student. 1 tuition 19560 2 books and supplies 1001 3 room and board 9504 and 4 computersoftware 2397. See Qualified Education Expenses earlier. _____ in qualified education expenses were included in your tax return on Form 8863 to calculate your education credit.

Source: pinterest.com

Source: pinterest.com

Enter the total of all amounts from Part III line 31 on Part II line 10. _____ in qualified education expenses were included in your tax return on Form 8863 to calculate your education credit. If the resulting qualified expenses are less than 4000 the student may choose to treat some of the grant as income to make more of the expenses eligible for the credit. Enter the total of all amounts from all Parts III line 30 on Part I line 1. The 5600 scholarship will reduce his qualified education expenses and his adjusted qualified education expenses will be 4000.

Source: slideplayer.com

Source: slideplayer.com

He has the following expenses for 2019. Lifetime Learning Credit Line 31 Enter the students adjusted qualified education expenses on line 31. Mapping Diagram Worksheet Time Management Worksheets For Adults Scientific Notation Addition And Subtraction Independent Practice Worksheet Factor The Common Factor Out Of Each Expression Worksheet Cell Transport Review Worksheet Answer Key Electric Charge And Static Electricity Worksheet 21 Day Fix Worksheets Protein Structure Pogil Worksheet Answers Chapter 15. You can claim an education credit for qualified education expenses paid by cash check credit or debit card or paid with money from a loan. Fill out lines 27 through 30 for the American Opportunity Credit or line 31 for the Lifetime Learning Credit.

Source: pinterest.com

Source: pinterest.com

Get thousands of teacher-crafted activities that sync up with the school year. 1 tuition 19560 2 books and supplies 1001 3 room and board 9504 and 4 computersoftware 2397. Lifetime Learning Credit Line 31 Enter the students adjusted qualified education expenses on line 31. Based on your education expenses scholarships and grants reported on your Form 1098-T and information found on your account activity statement from your school we have filed your education credit in the following manner. Enter the total of all amounts from all Parts III line 30 on Part I line 1.

Source: ar.pinterest.com

Source: ar.pinterest.com

See Qualified Education Expenses earlier. Based on your education expenses scholarships and grants reported on your Form 1098-T and information found on your account activity statement from your school we have filed your education credit in the following manner. Use the Adjusted Qualified Education Expenses Worksheet next to figure each students adjusted qualified education expenses. 16 Deducted on Sched A 17 Used for credit or deduction 18 Used for exclusion See tax help 19 Total adjustments. If the amount in Box 5 is greater than the amount in Box 1 then you are not eligible to take an education credit.

Source: pinterest.com

Source: pinterest.com

Is this a bug in TurboTax when it is figuring out adjusted qualified education expenses for 529. That are adjusted education expenses were covered by end of qualified education deduction under another in the application automatically choose which expenses for courses to create the credits. Qualified education expenses must be paid by. 2 Elect the American Opportunity Credit 3 Elect the Lifetime Learning Credit 4 Elect the tuition and fees deduction 4 Not applicable. Ad The most comprehensive library of free printable worksheets digital games for kids.

Source: pinterest.com

Source: pinterest.com

Based on his adjusted qualified education expenses of 4000 Bill would be able to claim an American opportunity tax credit of 2500. Use the Adjusted Qualified Education Expenses Worksheet to calculate the amount for line 27 reducing education expenses by any tax-free scholarships and grants. Fill out lines 27 through 30 for the American Opportunity Credit or line 31 for the Lifetime Learning Credit. 20 Adjusted qualified expenses Page 3 Part VII Education Credit or Deduction Election 1 Elect credit or deduction which results in best tax outcome. A third party including relatives or friends.

Source: pinterest.com

Source: pinterest.com

_____ in qualified education expenses were included in your tax return on Form 8863 to calculate your education credit. Mapping Diagram Worksheet Time Management Worksheets For Adults Scientific Notation Addition And Subtraction Independent Practice Worksheet Factor The Common Factor Out Of Each Expression Worksheet Cell Transport Review Worksheet Answer Key Electric Charge And Static Electricity Worksheet 21 Day Fix Worksheets Protein Structure Pogil Worksheet Answers Chapter 15. Based on his adjusted qualified education expenses of 4000 Bill would be able to claim an American opportunity tax credit of 2500. Based on your education expenses scholarships and grants reported on your Form 1098-T and information found on your account activity statement from your school we have filed your education credit in the following manner. 1 tuition 19560 2 books and supplies 1001 3 room and board 9504 and 4 computersoftware 2397.

Source: in.pinterest.com

Source: in.pinterest.com

_____ in qualified education expenses were included in your tax return on Form 8863 to calculate your education credit. Pymt Recd Qual Tuition - Scholarships and Grants - Nonqualified Expenses - Ins Contract Reimb Non-institution Expenses limited to 4000. Ad The most comprehensive library of free printable worksheets digital games for kids. How to fill out adjusted qualified education expenses worksheet. That are adjusted education expenses were covered by end of qualified education deduction under another in the application automatically choose which expenses for courses to create the credits.

Source: pinterest.com

Source: pinterest.com

See Qualified Education Expenses earlier. Dont enter more than 4000. For example Box 5 is 1000 and Box 1 is 3000 then the qualified expense amount would be 2000 plus any books or supplies. You can claim an education credit for qualified education expenses paid by cash check credit or debit card or paid with money from a loan. Ad The most comprehensive library of free printable worksheets digital games for kids.

Source: pinterest.com

Source: pinterest.com

Use the Adjusted Qualified Education Expenses Worksheet next to figure each students adjusted qualified education expenses. Fill out lines 27 through 30 for the American Opportunity Credit or line 31 for the Lifetime Learning Credit. Is this a bug in TurboTax when it is figuring out adjusted qualified education expenses for 529. Dont enter more than 4000. Ad The most comprehensive library of free printable worksheets digital games for kids.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title adjusted qualified education expenses worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.