Your 2019 capital loss carryover worksheet images are available. 2019 capital loss carryover worksheet are a topic that is being searched for and liked by netizens now. You can Find and Download the 2019 capital loss carryover worksheet files here. Find and Download all free vectors.

If you’re looking for 2019 capital loss carryover worksheet pictures information related to the 2019 capital loss carryover worksheet topic, you have visit the right site. Our site always provides you with suggestions for seeking the highest quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

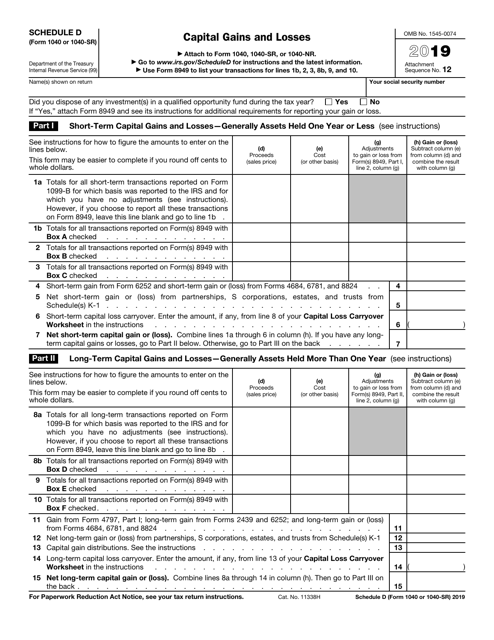

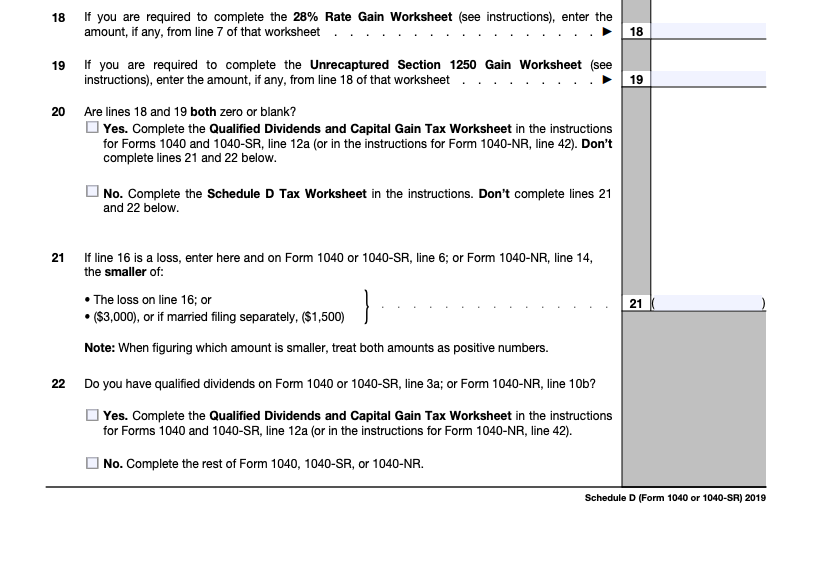

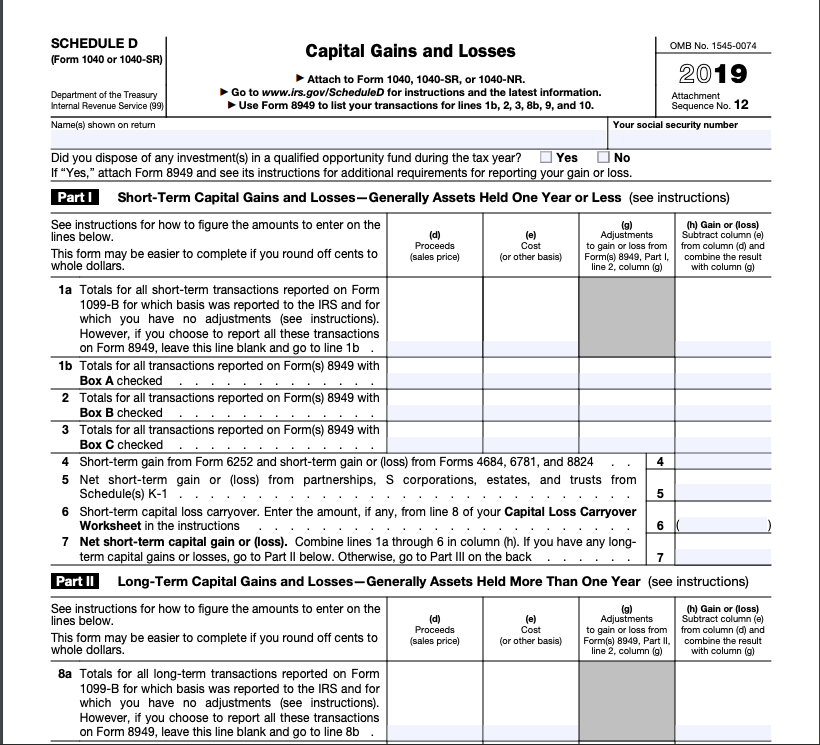

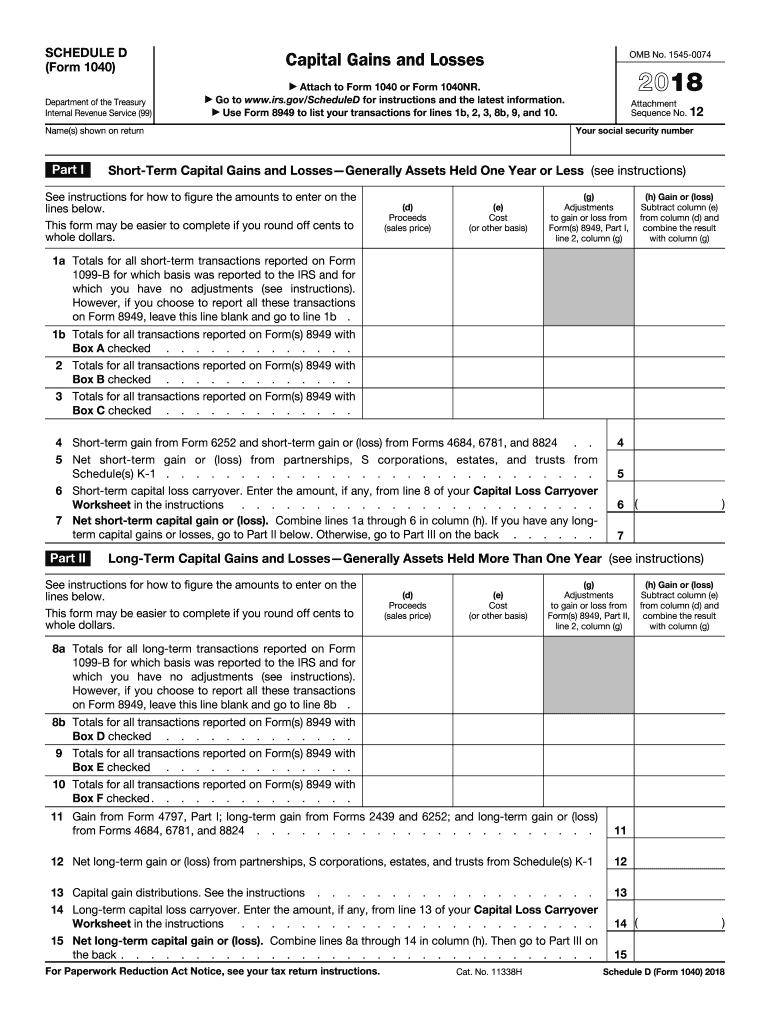

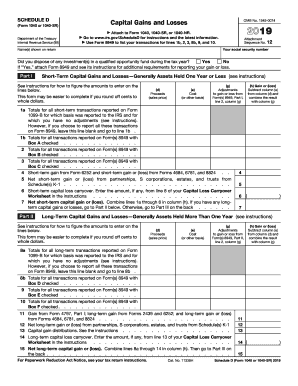

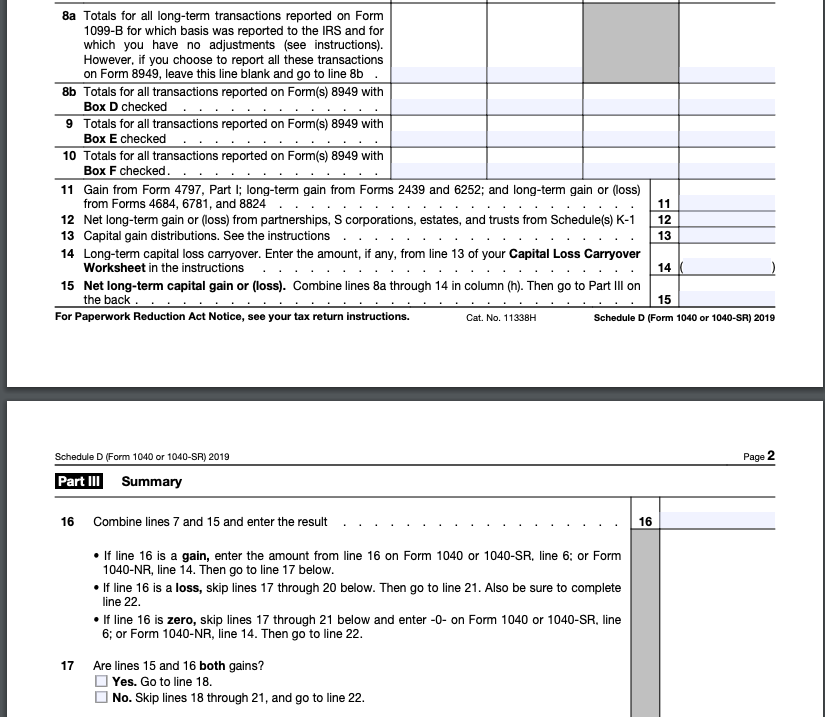

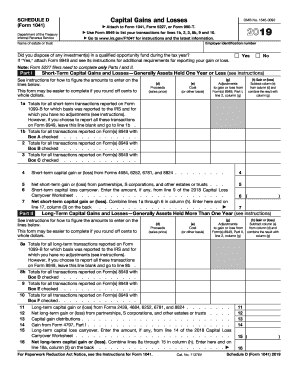

2019 Capital Loss Carryover Worksheet. 2019 Capital Loss Carryover We hope this 150200 tax breaks gives you a boost. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Capital Loss Carryover Worksheet. If Schedule D lines 15 and 16 are losses then you might have a capital loss carryover to 2020.

Schedule D Capital Loss Carryover Scheduled From kb.drakesoftware.com

Schedule D Capital Loss Carryover Scheduled From kb.drakesoftware.com

Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if. 12-07-2019 0108 AM. Fill out securely sign print or email your capital loss carryover worksheet 2019 to 2020 instantly with signNow. I have a capital loss carryover from 2018. Get thousands of teacher-crafted activities that sync up with the school year. Use the worksheet on this page to figure your capital loss carryover to 2020.

Use this worksheet to figure your capital loss carryovers from 2019 to 2020 if your 2019 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2019 Schedule D line 16 or b if the amount on your 2019 Form 1040 or 1040-SR line 11b or your 2019 Form 1040-NR line 41 if applicable would be less than zero.

If line 8 is a net capital loss enter the smaller of the loss on line 8 or 3000 1500 if you are married or an RDP filing a separate return. That bug affects the 2019 Schedule D Capital Loss Carryover Worksheet line D taxable income from 2018 1040 line 10 that can affect the other figures on the worksheet. 544 Sales and Other Dispositions of Assets. Capital Loss Carryover Worksheet. I have a capital loss carryover from 2018. 1040-SR line 7 or effectively connected capital gain distributions not reported direct- ly on Form 1040-NR line 7.

Source: templateroller.com

Source: templateroller.com

The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if. The capital loss carryover column is showing how much youll have leftover for next year. Use this worksheet to figure your capital loss carryovers from 2019 to 2020 if your 2019 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2019 Schedule D line 16 or b if the amount on your 2019 Form 1040 or 1040-SR line 11b or your 2019 Form 1040-NR line 41 if applicable would be less than zero. On the 2018 return - Schedule D line 15 - long-term capital loss carryover is the correct amount.

Source: uslegalforms.com

Source: uslegalforms.com

And To report a capital loss carryover from 2019 to 2020. Filing Form 1045 with a carryback to a sec-. Meaning the 2019 column shows your remaining loss usable in 2020 taxes. Get thousands of teacher-crafted activities that sync up with the school year. Fill out securely sign print or email your capital loss carryover worksheet 2019 to 2020 instantly with signNow.

Source: bogleheads.org

Source: bogleheads.org

So the unused capital loss should be able to carryforward to next year 2019 As a result it should use the formula to get the raw data for 2018 Form 1040 line 10 NOT the amount literally from line 10 for Capital Loss Carryover Worksheet line 1. A capital loss carryover from 2018 to 2019. Filing Form 1045 with a carryback to a sec-. Client Trust 1041 return has a long term capital loss carryover from 2017. How To Get Tax Help.

Source: pdffiller.com

Source: pdffiller.com

544 Sales and Other Dispositions of Assets. Your total net loss appears on line 21 of the 2020 Schedule D and transfers to line 7 of the 2020 Form 1040 that youll file in 2021. And To report a capital loss carryover from 2019 to 2020. I followed the prompts and it generated the correct amount but it lists it under 2018 and shows 000 under 2019. And the Instructions for Form 8949.

Source: chegg.com

Source: chegg.com

Get thousands of teacher-crafted activities that sync up with the school year. A capital loss carryover from 2018 to 2019. NOL Carryover From 2019 to 2020. Schedule D 540NR Worksheet for Nonresidents and Part-Year Residents. Use this worksheet to figure your capital loss carryovers from 2019 to 2020 if your 2019 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2019 Schedule D line 16 or b if the amount on your 2019 Form 1040 or 1040-SR line 11b or your 2019 Form 1040-NR line 41 if applicable would be less than zero.

Source: promotiontablecovers.blogspot.com

Source: promotiontablecovers.blogspot.com

Capital Loss Carryover Worksheet. Capital gains capital losses and tax loss carry-forwards are reported on IRS Form 8949 and Schedule D When reported correctly these forms will help you keep track of any capital loss carryover. 12-07-2019 0108 AM. If you have a net capital loss greater than 3000 for the year – that is if your capital losses exceed your gains by more than 3000 – you wont be able to deduct all your losses this year. Capital Loss Carryover Worksheet.

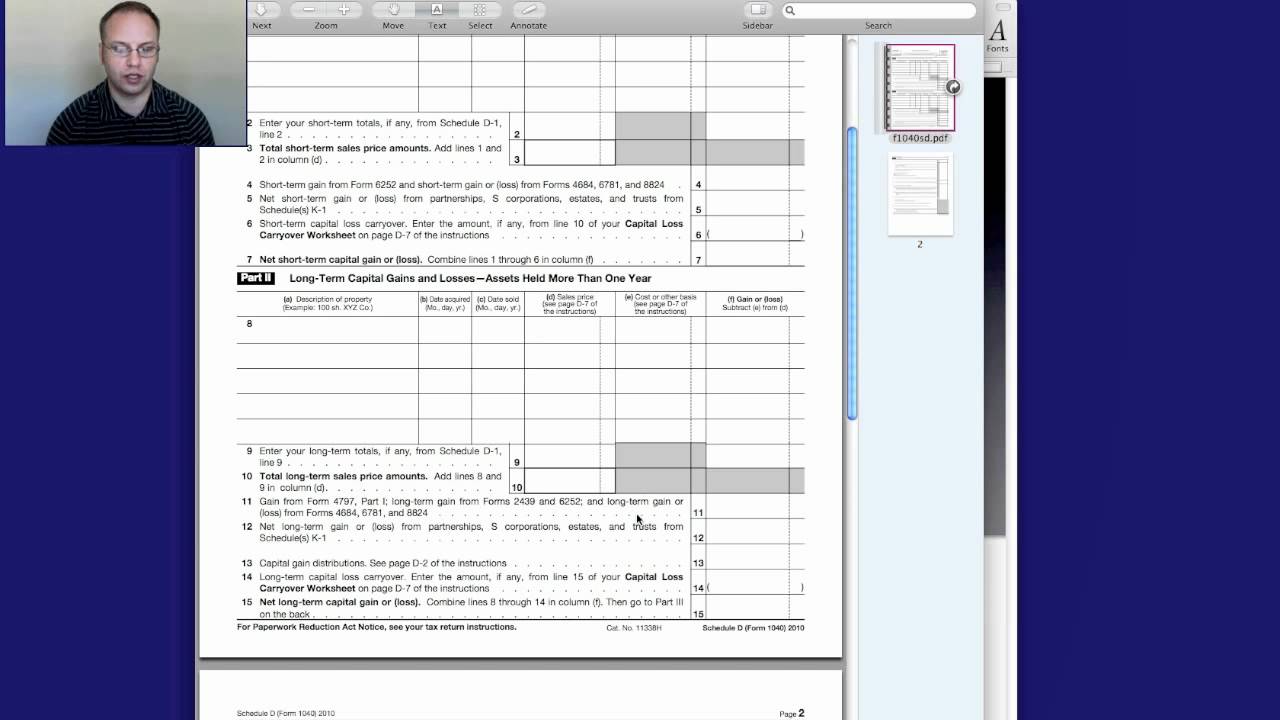

Source: youtube.com

Source: youtube.com

For more information see Pub. California Capital Loss Carryover Worksheet For Full-Year Residents. 1040-SR line 7 or effectively connected capital gain distributions not reported direct- ly on Form 1040-NR line 7. On the 2018 return - Schedule D line 15 - long-term capital loss carryover is the correct amount. Capital Loss Carryover Worksheet.

Source: fairmark.com

Source: fairmark.com

Look at Schedule D lines 15 and 16 of your 2019 tax return. Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if. 551 Basis of Assets. Other Forms You May Have To File Use Form 8949 to report the sale or exchange of a capital asset defined later not reported on another form or schedule. However page 2 Schedule D PART III line 18c has a number for 28 rate gain pulling from a 28 Rate Gain Worksheet – WHICH IS.

Irsgov Use this worksheet to figure your capital loss carryovers from 2019 to 2020 if your 2019 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2019 Schedule D line 16 or b if the amount on your 2019 Form 1040 or 1040-SR line 11b or your 2019 Form 1040-NR line 41 if applicable would be less. NOL Carryover From 2019 to 2020. Client Trust 1041 return has a long term capital loss carryover from 2017. I have a capital loss carryover from 2018. Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if.

Source: theofy.world

Source: theofy.world

Schedule D 540NR Worksheet for Nonresidents and Part-Year Residents. If Schedule D lines 15 and 16 are losses then you might have a capital loss carryover to 2020. The capital loss carryover column is showing how much youll have leftover for next year. And To report a capital loss carryover from 2019 to 2020. Use the worksheet on this page to figure your capital loss carryover to 2020.

Source: chegg.com

Source: chegg.com

Use the Capital Loss Carryover Worksheet in the 2020 Schedule D instructions to calculate the amount of the carryover and whether it. Get thousands of teacher-crafted activities that sync up with the school year. Fill out securely sign print or email your capital loss carryover worksheet 2019 to 2020 instantly with signNow. Capital gains capital losses and tax loss carry-forwards are reported on IRS Form 8949 and Schedule D When reported correctly these forms will help you keep track of any capital loss carryover. However page 2 Schedule D PART III line 18c has a number for 28 rate gain pulling from a 28 Rate Gain Worksheet – WHICH IS.

Source: nidecmege.blogspot.com

Source: nidecmege.blogspot.com

Capital Loss Carryover Worksheet. The capital loss carryover column is showing how much youll have leftover for next year. Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if. Get thousands of teacher-crafted activities that sync up with the school year. Id suggest to the product people that this row should be called capital loss carryover used instead and the columns should match the year its used in.

Source: kb.drakesoftware.com

Source: kb.drakesoftware.com

Client Trust 1041 return has a long term capital loss carryover from 2017. Client Trust 1041 return has a long term capital loss carryover from 2017. 551 Basis of Assets. I have a capital loss carryover from 2018. If Schedule D lines 15 and 16 are losses then you might have a capital loss carryover to 2020.

Source: theofy.world

Source: theofy.world

Ad The most comprehensive library of free printable worksheets digital games for kids. California Capital Loss Carryover Worksheet For Full-Year Residents. See section 4012b of Rev. If you have a net capital loss greater than 3000 for the year – that is if your capital losses exceed your gains by more than 3000 – you wont be able to deduct all your losses this year. 2019 Capital Loss Carryover We hope this 150200 tax breaks gives you a boost.

Source: chegg.com

Source: chegg.com

If Schedule D lines 15 and 16 are losses then you might have a capital loss carryover to 2020. Look at Schedule D lines 15 and 16 of your 2019 tax return. How To Get Tax Help. Irsgov Use this worksheet to figure your capital loss carryovers from 2019 to 2020 if your 2019 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2019 Schedule D line 16 or b if the amount on your 2019 Form 1040 or 1040-SR line 11b or your 2019 Form 1040-NR line 41 if applicable would be less. And the Instructions for Form 8949.

Source: rlsglobalconsultinggov.com

Source: rlsglobalconsultinggov.com

Other Forms You May Have To File Use Form 8949 to report the sale or exchange of a capital asset defined later not reported on another form or schedule. That bug affects the 2019 Schedule D Capital Loss Carryover Worksheet line D taxable income from 2018 1040 line 10 that can affect the other figures on the worksheet. Use this worksheet to figure your capital loss carryovers from 2019 to 2020 if your 2019 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2019 Schedule D line 16 or b if the amount on your 2019 Form 1040 or 1040-SR line 11b or your 2019 Form 1040-NR line 41 if applicable would be less than zero. If you have a net capital loss greater than 3000 for the year – that is if your capital losses exceed your gains by more than 3000 – you wont be able to deduct all your losses this year. For more information see Pub.

Source: uslegalforms.com

Source: uslegalforms.com

On the 2018 return - Schedule D line 15 - long-term capital loss carryover is the correct amount. 544 Sales and Other Dispositions of Assets. However page 2 Schedule D PART III line 18c has a number for 28 rate gain pulling from a 28 Rate Gain Worksheet – WHICH IS. Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if. I have a capital loss carryover from 2018.

Source: signnow.com

Source: signnow.com

However you will be able to carryover any losses that exceed 3000 and deduct them in future years. Ad The most comprehensive library of free printable worksheets digital games for kids. If line 8 is a net capital loss enter the smaller of the loss on line 8 or 3000 1500 if you are married or an RDP filing a separate return. After completing the prompts it even tells me. 12-07-2019 0108 AM.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 2019 capital loss carryover worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.