Your 2018 schedule d tax worksheet images are ready. 2018 schedule d tax worksheet are a topic that is being searched for and liked by netizens today. You can Find and Download the 2018 schedule d tax worksheet files here. Find and Download all free photos.

If you’re looking for 2018 schedule d tax worksheet images information related to the 2018 schedule d tax worksheet keyword, you have visit the ideal site. Our website always provides you with hints for seeking the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

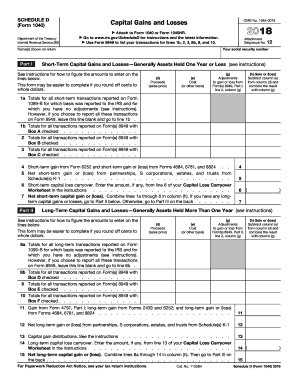

2018 Schedule D Tax Worksheet. The revised worksheet corrects a rate error that may have calculated an incorrect tax liability for some investors. Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. Form 1040 Schedule D Capital Gains and Losses 2018 Inst 1040 Schedule D Instructions for Schedule D Form 1040 or Form 1040-SR Capital Gains and Losses 2018 Form 1040 Schedule D Capital Gains and Losses 2017 Inst 1040 Schedule D. 20 Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10.

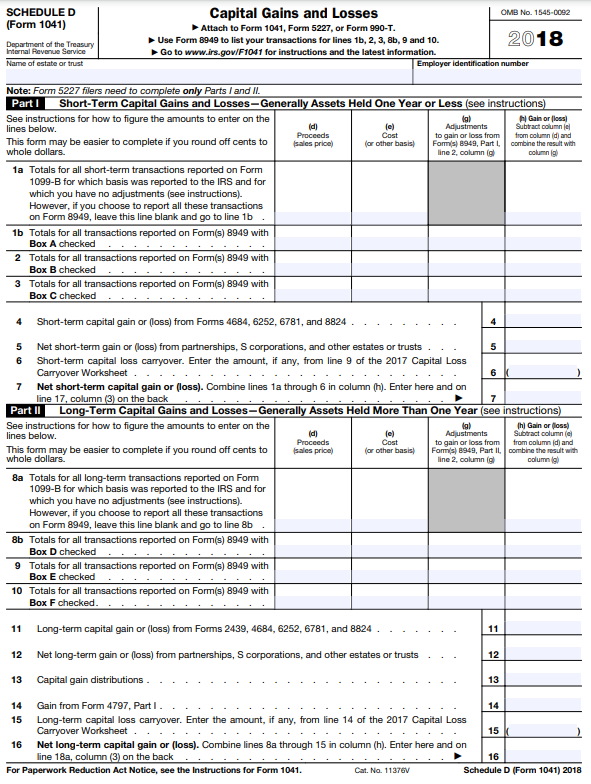

To figure the overall gain or. To start the document use the Fill Sign Online button or tick the preview image of the form. Revised Instructions to 2018 Schedule D If youve already filed your 2018 federal income tax return and used the worksheet in the instructions to Schedule D to figure the 25 tax rate on unrecaptured depreciation and the 28 tax rate applicable to gain on the sale of collectibles your taxes. Go to wwwirsgovForm1120S for instructions and the latest information. The IRS posted updated instructions for 2018 Schedule D Form 1040 Capital Gains and Losses that include a corrected worksheet. IRS announces change to 2018 Schedule D Tax Worksheet The IRS has shared with the professional tax software community that they have found that the Schedule D Tax Worksheet for Forms 1040 and 1041 were not properly taxing certain capital gains at the new lower 2018 tax rates but instead the worksheet was taxing them at their maximum rate of 25 or 28.

The Internal Revenue Service has posted a revised 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1040 after finding out that it contained an error that ended up calculating higher taxes for many investors.

The form analyzes the income from the tax filer and calculates just how much to become paid as tax or refund. The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1041 contained an error that affected certain taxpayers who had 28 rate gain or unrecaptured section 1250 gain. 2018 Instructions for Schedule DCapital Gains and Losses These instructions explain how to complete Schedule D Form 1040. On May 16 2019 the IRS posted a corrected version of the worksheet which can be found at the end of the updated instructions at the link above. Most tax software followed the erroneous worksheet for returns prepared during the filing season. The Internal Revenue Service has posted a revised 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1040 after finding out that it contained an error that ended up calculating higher taxes for many investors.

Source: signnow.com

Source: signnow.com

The IRS announced the agency has discovered an error that existed in the worksheets for calculating tax due that were in the Schedule D instructions for 2018 returns Error in Tax Calculation in Schedule D Tax Worksheet Form 10401. Form 1040 Schedule D Capital Gains and Losses 2018 Inst 1040 Schedule D Instructions for Schedule D Form 1040 or Form 1040-SR Capital Gains and Losses 2018 Form 1040 Schedule D Capital Gains and Losses 2017 Inst 1040 Schedule D. SignNow has paid close attention to iOS users and developed an. Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. IRS announces change to 2018 Schedule D Tax Worksheet The IRS has shared with the professional tax software community that they have found that the Schedule D Tax Worksheet for Forms 1040 and 1041 were not properly taxing certain capital gains at the new lower 2018 tax rates but instead the worksheet was taxing them at their maximum rate of 25 or 28.

Source: tokentax.co

Source: tokentax.co

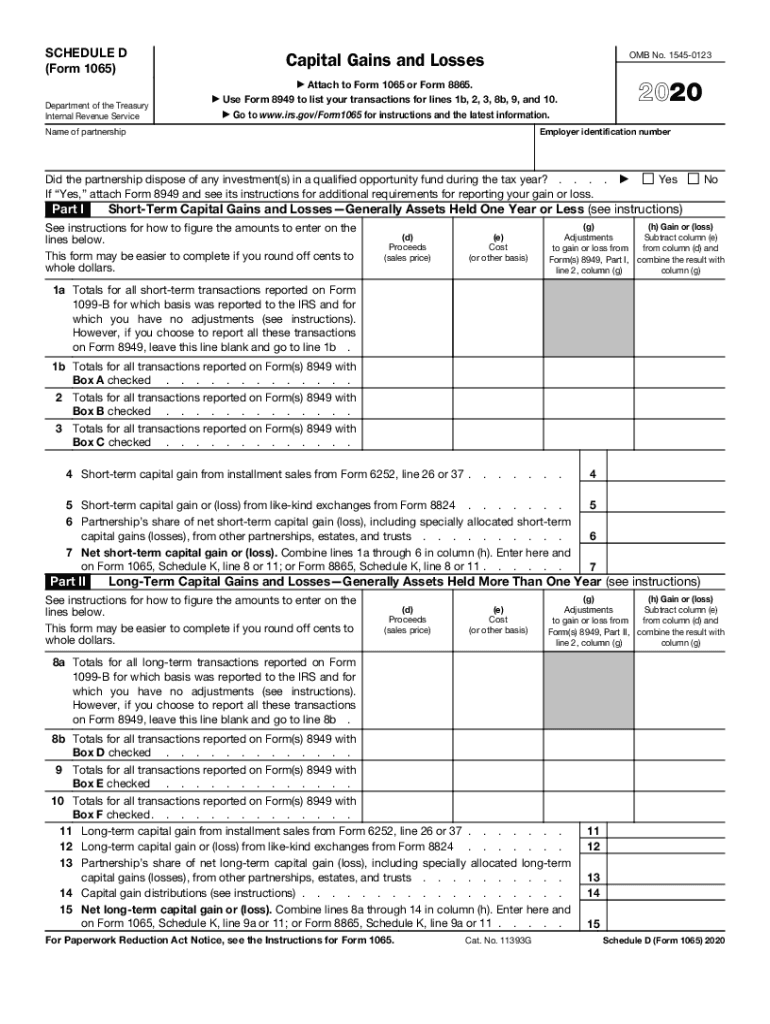

SignNow has paid close attention to iOS users and developed an. In May of 2019 the IRS revised the 2018 form and instructions for Schedule D. How to generate an e-signature for the 2018 Schedule D Form 1065 Internal Revenue Service on iOS devices schedule d worksheet easily create electronic signatures for signing a irs schedule d tax worksheet in PDF format. 20 Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g even if you dont need to file Schedule D.

To figure the overall gain or. The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D filers who had 28 rate gain taxed at a maximum rate of 28 reported on line 18 of Schedule D or unrecaptured section 1250 gain taxed at a maximum rate of 25. 2018 Form 1040 Schedule D Tax Worksheet The IRS Form 1040 form is the standard one that many individuals use to submit their tax returns to the government. Revised Instructions to 2018 Schedule D If youve already filed your 2018 federal income tax return and used the worksheet in the instructions to Schedule D to figure the 25 tax rate on unrecaptured depreciation and the 28 tax rate applicable to gain on the sale of collectibles your taxes. The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1041 contained an error that affected certain taxpayers who had 28 rate gain or unrecaptured section 1250 gain.

IRS announces change to 2018 Schedule D Tax Worksheet The IRS has reported to the professional tax software community that they have found that the Schedule D Tax Worksheet for Forms 1040 and 1041 were not properly taxing certain capital gains at the new lower 2018 tax rates but instead the worksheet was taxing them at their maximum rate of 25 or 28. How to generate an e-signature for the 2018 Schedule D Form 1065 Internal Revenue Service on iOS devices schedule d worksheet easily create electronic signatures for signing a irs schedule d tax worksheet in PDF format. On May 16 2019 the IRS posted a corrected version of the worksheet which can be found at the end of the updated instructions at the link above. The advanced tools of the editor will direct you through the editable PDF template. Form 1040 Schedule D Capital Gains and Losses 2018 Inst 1040 Schedule D Instructions for Schedule D Form 1040 or Form 1040-SR Capital Gains and Losses 2018 Form 1040 Schedule D Capital Gains and Losses 2017 Inst 1040 Schedule D.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

If you received capital gain distribu-tions as a nominee that is they were paid to you but actually belong to some-one else report on Schedule D line 13 only the amount that belongs to you. This form describes your income and your tax return status and it is used from the IRS to collect your tax information. The revised worksheet corrects a rate error that may have calculated an incorrect tax liability for some investors. SignNow has paid close attention to iOS users and developed an. Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g even if you dont need to file Schedule D.

Source: 1065-d.pdffiller.com

Source: 1065-d.pdffiller.com

Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g even if you dont need to file Schedule D. 20 Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D filers who had 28 rate gain taxed at a maximum rate of 28 reported on line 18 of Schedule D or unrecaptured section 1250 gain taxed at a maximum rate of 25. 2018 Form 1040 Schedule D Tax Worksheet The IRS Form 1040 form is the standard one that many individuals use to submit their tax returns to the government. Form 1040 Schedule D Capital Gains and Losses 2018 Inst 1040 Schedule D Instructions for Schedule D Form 1040 or Form 1040-SR Capital Gains and Losses 2018 Form 1040 Schedule D Capital Gains and Losses 2017 Inst 1040 Schedule D.

20 Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. Most tax software followed the erroneous worksheet for returns prepared during the filing season. It demands the filer to fill the form with accurate info. The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1040 contained an error. The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1041 contained an error that affected certain taxpayers who had 28 rate gain or unrecaptured section 1250 gain.

Source: drakesoftware.com

Source: drakesoftware.com

The way to complete the 990 schedule dsignNowcom 2018-2019 form on the web. Go to wwwirsgovForm1120S for instructions and the latest information. SCHEDULE D Form 1120S Department of the Treasury Internal Revenue Service Capital Gains and Losses and Built-in Gains Attach to Form 1120S. The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1041 contained an error that affected certain taxpayers who had 28 rate gain or unrecaptured section 1250 gain. The Internal Revenue Service has posted a revised 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1040 after finding out that it contained an error that ended up calculating higher taxes for many investors.

Go to wwwirsgovForm1120S for instructions and the latest information. Form 1040 Schedule D Capital Gains and Losses 2018 Inst 1040 Schedule D Instructions for Schedule D Form 1040 or Form 1040-SR Capital Gains and Losses 2018 Form 1040 Schedule D Capital Gains and Losses 2017 Inst 1040 Schedule D. Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D. SCHEDULE D Form 1120S Department of the Treasury Internal Revenue Service Capital Gains and Losses and Built-in Gains Attach to Form 1120S. The revised worksheet corrects a rate error that may have calculated an incorrect tax liability for some investors.

Source: lattaharris.com

Source: lattaharris.com

IRS notices are being sent to some taxpayers because the 2018 tax law changes did not get incorporated into the 2018 form used for calculating income taxes when certain capital gains transactions existed. Go to wwwirsgovForm1120S for instructions and the latest information. IRS announces change to 2018 Schedule D Tax Worksheet The IRS has reported to the professional tax software community that they have found that the Schedule D Tax Worksheet for Forms 1040 and 1041 were not properly taxing certain capital gains at the new lower 2018 tax rates but instead the worksheet was taxing them at their maximum rate of 25 or 28. The way to complete the 990 schedule dsignNowcom 2018-2019 form on the web. This form describes your income and your tax return status and it is used from the IRS to gather your tax.

Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. It demands the filer to fill the form with accurate info. How to generate an e-signature for the 2018 Schedule D Form 1065 Internal Revenue Service on iOS devices schedule d worksheet easily create electronic signatures for signing a irs schedule d tax worksheet in PDF format. Go to wwwirsgovForm1120S for instructions and the latest information. To figure the overall gain or.

Source: theofy.world

Source: theofy.world

IRS announces change to 2018 Schedule D Tax Worksheet The IRS has shared with the professional tax software community that they have found that the Schedule D Tax Worksheet for Forms 1040 and 1041 were not properly taxing certain capital gains at the new lower 2018 tax rates but instead the worksheet was taxing them at their maximum rate of 25 or 28. Form 1040 Schedule D Capital Gains and Losses 2018 Inst 1040 Schedule D Instructions for Schedule D Form 1040 or Form 1040-SR Capital Gains and Losses 2018 Form 1040 Schedule D Capital Gains and Losses 2017 Inst 1040 Schedule D. To figure the overall gain or. The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1041 contained an error that affected certain taxpayers who had 28 rate gain or unrecaptured section 1250 gain. Revised Instructions to 2018 Schedule D If youve already filed your 2018 federal income tax return and used the worksheet in the instructions to Schedule D to figure the 25 tax rate on unrecaptured depreciation and the 28 tax rate applicable to gain on the sale of collectibles your taxes.

Source: shannon-cpas.com

Source: shannon-cpas.com

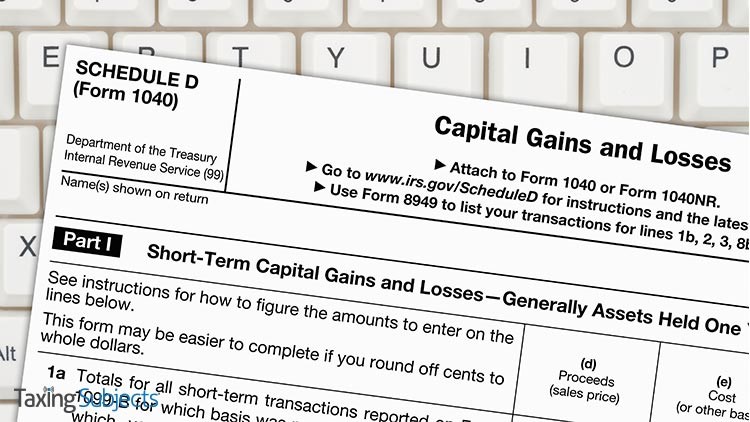

Form 1040 Schedule D Worksheet Form 1040 form is an IRS tax form utilized for person federal income tax filings by US residents. Form 1040 Schedule D Capital Gains and Losses 2018 Inst 1040 Schedule D Instructions for Schedule D Form 1040 or Form 1040-SR Capital Gains and Losses 2018 Form 1040 Schedule D Capital Gains and Losses 2017 Inst 1040 Schedule D. This form describes your income and your tax return status and it is used from the IRS to collect your tax information. How to generate an e-signature for the 2018 Schedule D Form 1065 Internal Revenue Service on iOS devices schedule d worksheet easily create electronic signatures for signing a irs schedule d tax worksheet in PDF format. 2018 Form 1040 Schedule D Tax Worksheet The IRS Form 1040 form is the standard one that many individuals use to submit their tax returns to the government.

SignNow has paid close attention to iOS users and developed an. SCHEDULE D Form 1040 Department of the Treasury Internal Revenue Service 99 Capital Gains and Losses Attach to Form 1040 or Form 1040NR. The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1041 contained an error that affected certain taxpayers who had 28 rate gain or unrecaptured section 1250 gain. The revised worksheet corrects a rate error that may have calculated an incorrect tax liability for some investors. Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D.

Source: chegg.com

Source: chegg.com

IRS announces change to 2018 Schedule D Tax Worksheet The IRS has shared with the professional tax software community that they have found that the Schedule D Tax Worksheet for Forms 1040 and 1041 were not properly taxing certain capital gains at the new lower 2018 tax rates but instead the worksheet was taxing them at their maximum rate of 25 or 28. It demands the filer to fill the form with accurate info. Go to wwwirsgovScheduleD for instructions and the latest information. The tax calculation did not work correctly with the new TCJA regular tax rates and brackets for certain Schedule D filers who had 28 rate gain taxed at a maximum rate of 28 reported on line 18 of Schedule D or unrecaptured section 1250 gain taxed at a maximum rate of 25. To start the document use the Fill Sign Online button or tick the preview image of the form.

Source: flaminke.com

Source: flaminke.com

Go to wwwirsgovScheduleD for instructions and the latest information. The 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1040 contained an error. SignNow has paid close attention to iOS users and developed an. To figure the overall gain or. 20 Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10.

Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g even if you dont need to file Schedule D. 20 Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10. 1040 Form 2018 Schedule D The IRS Form 1040 form is the standard one that a lot of people use to submit their tax returns to the government. The IRS posted updated instructions for 2018 Schedule D Form 1040 Capital Gains and Losses that include a corrected worksheet. The Internal Revenue Service has posted a revised 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1040 after finding out that it contained an error that ended up calculating higher taxes for many investors.

Source: gobankingrates.com

Source: gobankingrates.com

The Internal Revenue Service has posted a revised 2018 Schedule D Tax Worksheet in the Instructions for Schedule D Form 1040 after finding out that it contained an error that ended up calculating higher taxes for many investors. 2018 Form 1040 Schedule D Tax Worksheet The IRS Form 1040 form is the standard one that many individuals use to submit their tax returns to the government. IRS announces change to 2018 Schedule D Tax Worksheet The IRS has reported to the professional tax software community that they have found that the Schedule D Tax Worksheet for Forms 1040 and 1041 were not properly taxing certain capital gains at the new lower 2018 tax rates but instead the worksheet was taxing them at their maximum rate of 25 or 28. Most tax software followed the erroneous worksheet for returns prepared during the filing season. 2018 Instructions for Schedule DCapital Gains and Losses These instructions explain how to complete Schedule D Form 1040.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 2018 schedule d tax worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.